08/01/2025 Traders Mindset

Mental Challenges in Fast-Paced Markets

Key Takeaways:

- Mental challenges in trading are universal, affecting traders of all levels.

- Common challenges include information overload, FOMO, handling losses, overconfidence, and stress.

- These challenges often arise during volatile market conditions or after significant gains or losses.

- Overcoming these issues involves discipline, reflective practices, and stress management techniques to maintain emotional balance and decision-making clarity.

Who Faces These Challenges?

Anyone navigating the fast-paced environment of financial markets encounters mental challenges. This includes day traders who make numerous trades within a single day, long-term investors who manage portfolios over extended periods, and even portfolio managers who oversee substantial assets. The psychological pressures are not bound by expertise. Novices, as they acquaint themselves with market dynamics, and seasoned veterans, who must continuously evolve with the market, are both equally exposed to these challenges.

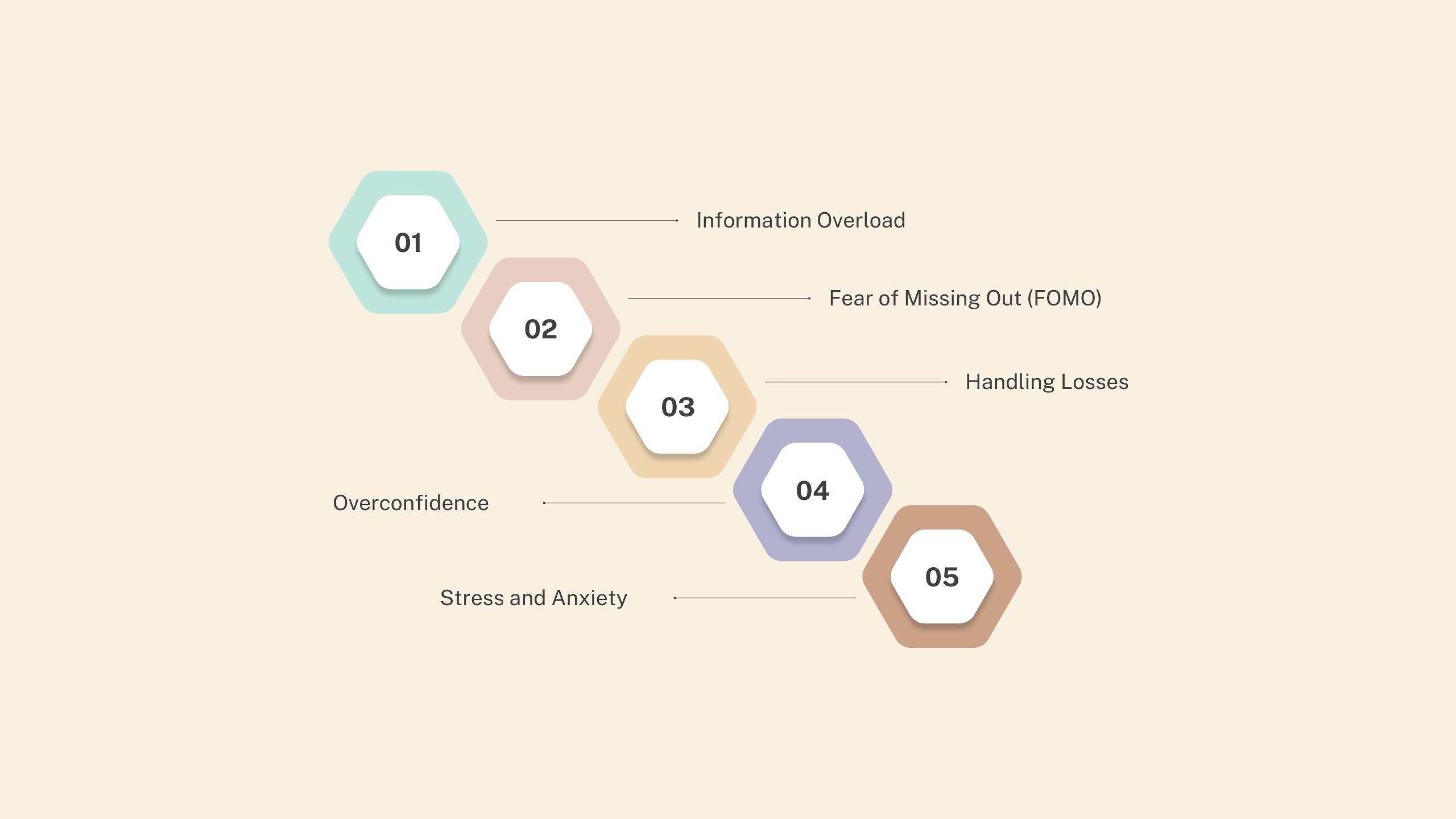

What Are the Common Mental Challenges?

Several psychological hurdles are prevalent in fast-paced trading environments. One major challenge is information overload. The flood of data, from news articles to real-time market updates, can be overwhelming, making it difficult for traders to distinguish between what’s critical and what’s merely noise. Another pervasive issue is the fear of missing out (FOMO), where traders rush into decisions, driven by the anxiety that they might miss lucrative opportunities that others are seizing. Additionally, handling losses can be particularly taxing. Losses, inevitable in trading, can lead to emotional reactions like revenge trading, where traders take larger risks in an attempt to quickly recover their losses. Overconfidence is another challenge; after a series of wins, traders might become complacent, believing they can’t lose, which can result in reckless decisions. Lastly, the constant demand to perform can induce stress and anxiety, affecting clear and rational decision-making.

When Do These Challenges Occur?

These mental challenges can strike at any moment during trading but are particularly intensified under certain circumstances. High volatility in markets, where prices change rapidly, can increase stress and prompt impulsive actions. After a series of losses, traders may feel defeated, while a streak of wins might lead to an inflated sense of confidence. Major economic announcements or unexpected news can also trigger sudden market movements, leading to panic or euphoria among traders.

Where Do These Challenges Manifest?

Though these challenges are internal, they manifest in traders' behaviors and environments. On trading platforms, the constant flow of data and price changes can create a pressure-filled atmosphere that encourages swift reactions. Personal workspaces can amplify or alleviate these challenges; a disorganized, noisy environment can exacerbate stress, while a tranquil, organized setting can help traders stay calm and focused. Furthermore, social media and news feeds can fuel FOMO and information overload, as traders are bombarded with external opinions and market chatter.

Why Do These Challenges Matter?

Addressing these mental challenges is essential for maintaining both mental well-being and financial success. Poor emotional control can lead to irrational decision-making, resulting in losses or missed opportunities. Over time, the stress from continuous market engagement without effective coping strategies can cause burnout, diminishing a trader’s overall performance and longevity in the field. By becoming self-aware of these psychological patterns, traders can develop strategies to mitigate their impact, fostering better trading discipline and improving long-term outcomes.

How Can You Overcome Them?

Overcoming these mental challenges involves adopting a proactive and strategic approach. To combat information overload, traders should prioritize data that aligns with their trading strategy, utilizing tools and alerts to streamline the information they receive. Addressing FOMO requires a well-structured trading plan with clear entry and exit points, encouraging reliance on one’s analysis rather than market hype. Handling losses involves accepting them as part of the trading journey and using each loss as a learning opportunity. For overconfidence, regularly reviewing one’s strategy and performance metrics can maintain humility and discipline. Finally, stress management techniques such as regular breaks, physical exercise, and mindfulness practices are crucial for maintaining emotional balance and clarity in decision-making.

© 2025 SKONE Enterprise (003319453-V). All rights reserved.

The content on this site is for informational purposes only and does not constitute financial advice.