You’re sitting in front of your trading screen. You’ve done the analysis, the setup looks perfect, and the chart signals align. You’re confident, maybe even a little excited. But here’s the question that stops you: How much should I risk?

Too much, and you could lose big. Too little, and the trade might not even be worth the effort. This is where position sizing becomes your lifeline.

What’s Position Sizing, Anyway?

Position sizing is like setting boundaries for a thrilling game. It’s deciding how much capital you’ll allocate to a single trade. The goal? To manage your risk while maximizing your potential reward.

Let’s break it down:

- You’ve got $10,000 in your account.

- You decide to risk 2% per trade.

- That means, for any trade, your maximum loss would be $200.

This keeps your losses in check and ensures you have enough to keep trading even after a few losses.

Picture this: You see a “can’t-miss” opportunity and go all in. You don’t think much about the size of your trade because you’re sure it will work. But the market doesn’t care about your certainty. The trade goes south, and suddenly you’ve lost half your account.

Without proper position sizing, this roller coaster ride doesn’t have a seatbelt. It’s risky, and it’s not sustainable.

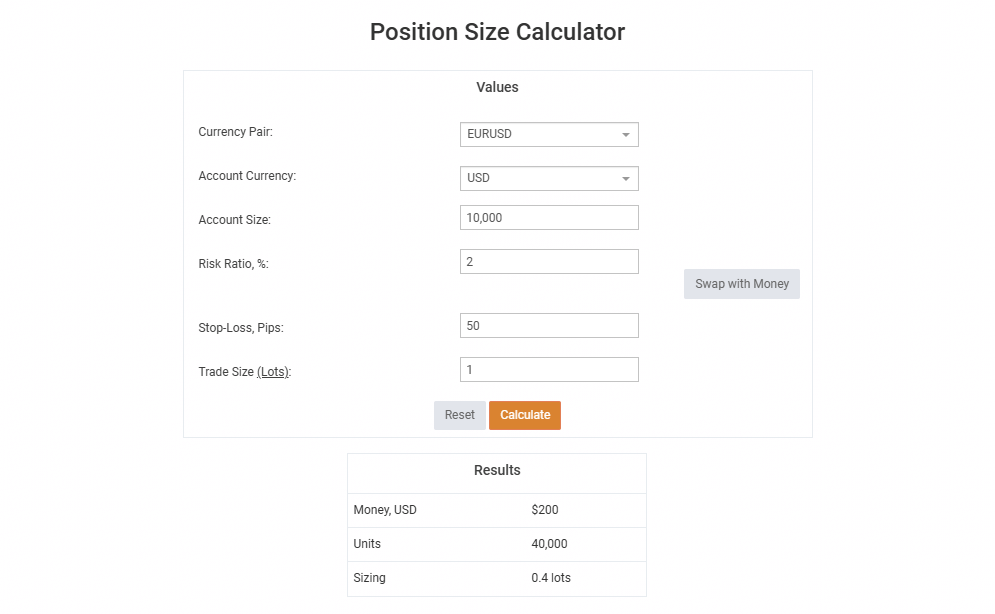

Now, imagine you’re trading EUR/USD. Your analysis shows a potential reward of 100 pips, but the stop loss is 50 pips away. Here’s how position sizing helps:

- If you’re risking $200 (2% of your $10,000 account), calculate your lot size based on the pip value.

- At $10 per pip for a standard lot, your lot size would be 0.4 (risking $200 for 50 pips).

You’re not betting your entire account; you’re sticking to a calculated plan.

The 3-Step Plan for Position Sizing

Step 1: Define Your Risk Per Trade

Decide what percentage of your account you’re willing to lose on a single trade. Most traders stick to 1-3%.

Step 2: Calculate Your Dollar Risk

Multiply your account size by your chosen percentage. This is your dollar risk.

Step 3: Adjust Lot Size or Position Size

Use your stop loss and dollar risk to determine the appropriate position size. Tools like position size calculators make this simple.

The Long-Term Game

Think of trading as a marathon, not a sprint. Position sizing protects you from wiping out in a losing streak and gives you the flexibility to recover.

For instance, if you’re down 10%, you only need an 11.1% gain to break even. But if you lose 50%, you’ll need a 100% gain to recover. Proper position sizing prevents these devastating scenarios.

Trading without position sizing is like driving without brakes. Sure, you might speed ahead for a while, but the crash will come sooner or later. With a calculated approach, you’re in control—balancing risk and reward with every trade.

Here are 2 of our favourite Position Size Calculators:

- https://www.myfxbook.com/forex-calculators/position-size

- https://www.babypips.com/tools/position-size-calculator

How do you stop putting off what matters most? Learn practical steps to Overcome Procrastination in the next post.